Have questions about the recent student loan forgiveness announcement?

I’ve got (some) answers.

(Please forward this article to anyone you know who might need some clarity about their student loans. There’s also a very important note about scams at the bottom that’s worth sharing. #themoreyouknow)

You’ve probably heard by now that the government plans to forgive federal student loans for roughly 20 million Americans.1

Here’s what we know about the loan forgiveness so far:2

- The Dept. of Education will forgive up to $10,000 in federal student loans to single borrowers who earned less than $125,000 and households that made less than $250,000 in 2020 or 2021.

- Borrowers of federally-held undergraduate, graduate, and Parent PLUS loans are eligible, even if the loans are in default.

- Recipients of Pell Grants will receive an extra $10,000 (totaling $20,000 in debt forgiveness) with the same income thresholds.

The student loan payment moratorium is also extended through December 31, 2022. This means payments start on your new balance on January 1, 2023.

But! Here’s a big detail that got left out of most headlines:

Under new Dept. of Education rules, monthly payments on undergraduate debt will be slashed to 5% of a borrower’s “discretionary income,” and the amount of income shielded from repayment calculations will also increase.3

This rule change could end up halving monthly payments for millions of folks and might be an even bigger deal than one-time forgiveness.

Will I owe taxes on the forgiven loan amount?

It depends. While you would typically owe federal taxes on forgiven debt, the American Rescue Plan exempted student loans from the usual federal tax rules.4

Many states have decided not to levy state taxes, but some states explicitly will or haven’t announced their position. Depending on where you file state income taxes, you may owe taxes.

What if I made loan payments during the moratorium? Can I get a refund?

Very likely. Any payments on your qualifying federal loans made since March 13, 2020 can be refunded by contacting your loan servicer.5

How do I get my loans (or my kids’ loans) forgiven?

According to the Dept. of Education, an online application will be available by October, and you’ll have until December 31, 2023 to apply.2

Those who filled out FAFSA forms in 2021-2022 for themselves or their dependent children may be automatically enrolled in the forgiveness program because their relevant income information is already on file.6

How big a deal is this whole thing, economically speaking?

Hard to say yet. Court challenges or administrative hurdles could change what actually happens and for whom.

Some folks think that forgiving student loans is a bad idea.

The thing is, the federal government has forgiven loans for defrauded students, small businesses, farms, and public service employees for years, so those concerns are probably overblown.

Goldman Sachs economists ran some numbers on the expected effect of the current plan on the economy; they concluded that it probably won’t have much macro impact at all, though the caps on monthly payments should increase household income.7

Should I take out more loans so they’ll be forgiven?

Please don’t. So far, only loans initially disbursed by June 30, 2022 will be covered by this plan. Anything taken out afterward will not be eligible.6

What do I need to do right now?

Nothing. Nada. Zilch. The details are still being hammered out and more information will be coming. A great place to get alerts is from the Dept. of Education. You can sign up for them here.

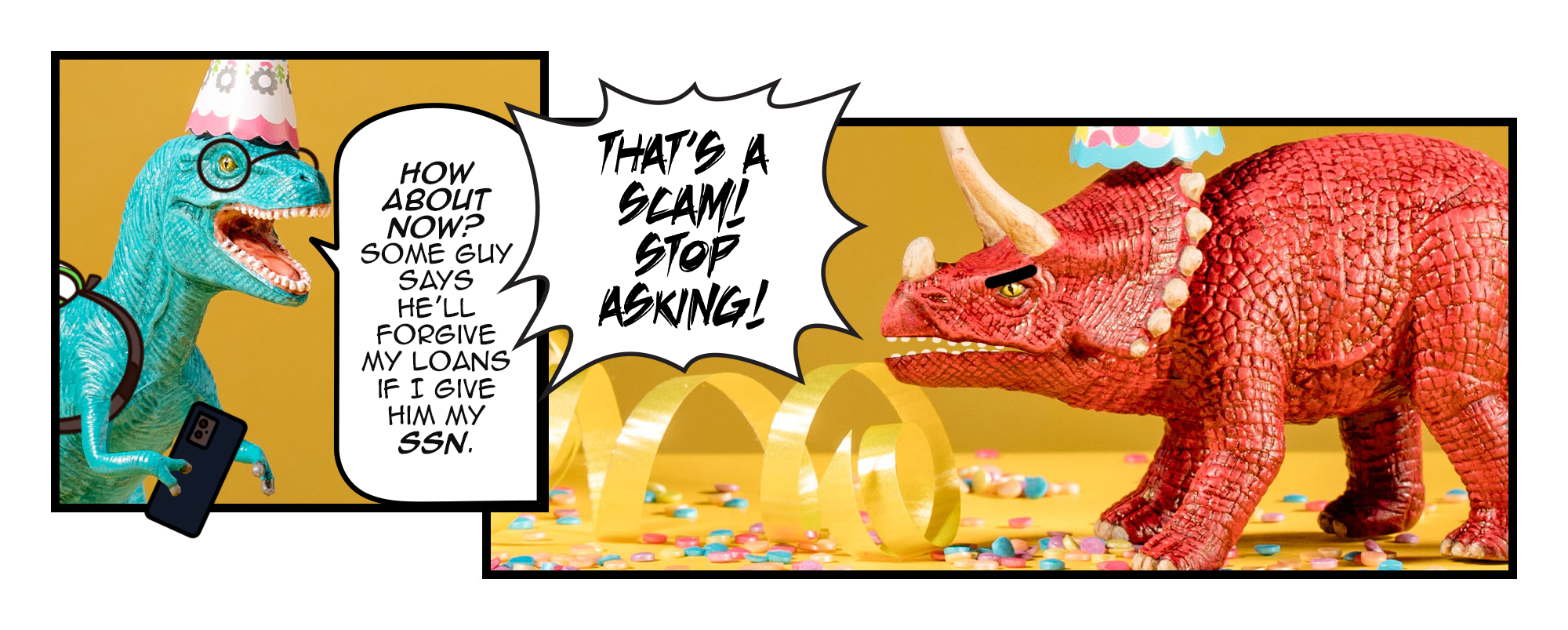

SCAM ALERT: We’re expecting A LOT of scammer activity targeting folks waiting for student loan relief. Please be VERY careful with emails or text messages claiming to be about your loans.

Get your information straight from reliable sources like the Dept. of Education and your student loan servicer’s official website (and me!).

If you’ve read all the way through, thanks for sticking with me. I know this was a lot of information all at once.

We’ll know more about the details of the plan in the weeks ahead, but if you have questions or want to update your strategies in anticipation of lower (or no) student loan payments, please hit “reply” to this email and we’ll set up a time.

P.S. Markets slumped as investors chewed on some pretty hawkish remarks by Federal Reserve chair Jerome Powell who intends to continue aggressively raising rates for the foreseeable future. Investors had hoped to see a pivot toward a more relaxed policy until Powell brought a dose of reality.8

What happens next? We’re likely to see continued volatility. Keep calm and carry on.

1 – https://www.cnbc.com/select/biden-to-erase-up-to-20k-in-student-loan-debt-heres-who-qualifies/

2 – https://studentaid.gov/debt-relief-announcement/one-time-cancellation

4 – https://taxfoundation.org/student-loan-debt-cancelation-tax-treatment/

8 – https://finance.yahoo.com/news/stock-market-tanked-since-jerome-211327050.html

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Investment advisory services offered through NewEdge Advisors, LLC, a registered investment advisor. Advisory services are only offered to clients or prospective clients where NewEdge Advisors, LLC doing business as WealthWorth and its representatives are properly licensed or exempt from licensure. The information contained herein is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by NewEdge Advisors, LLC dba WealthWorth unless a client service agreement is in place.