What’s more important to success, personality or IQ?

Believe it or not, it’s personality.

That’s because our personalities shape our feelings, behaviors, and perspective.

They also play puppet master for how open we are to learning, what we believe is “right,” and the choices we make.1

That’s how personality can take us further in life than book smarts alone.

And it doesn’t stop with our personal and professional lives.

We all have distinct money personalities too.

They naturally affect how we feel, handle, and think about money.2

So, what’s your money personality?

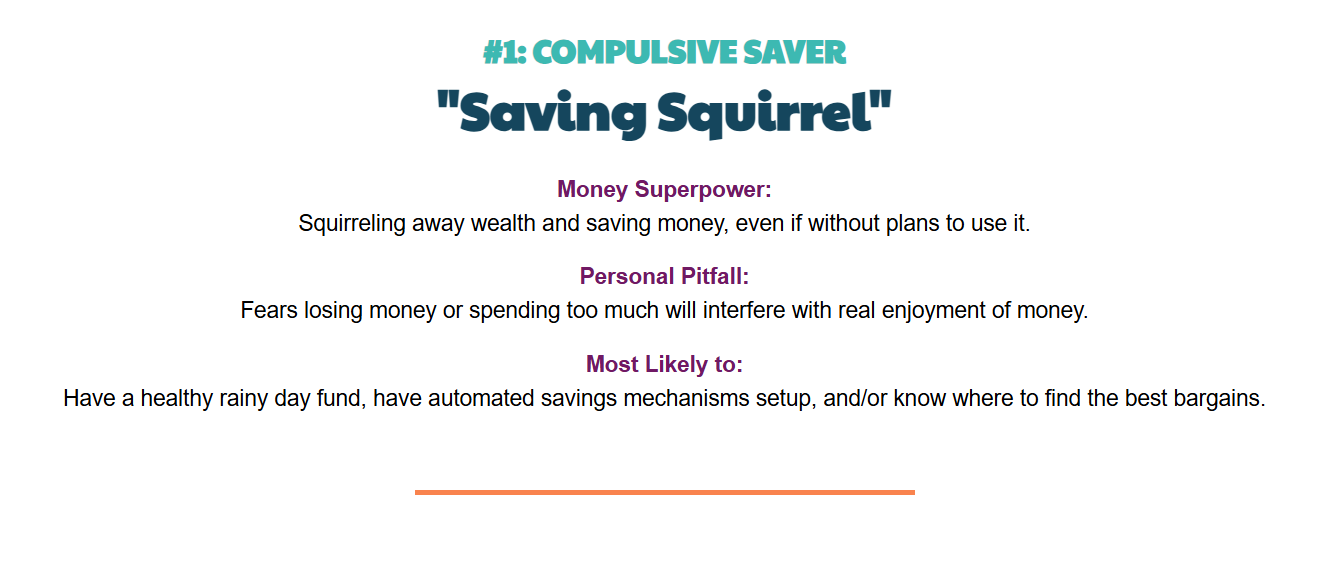

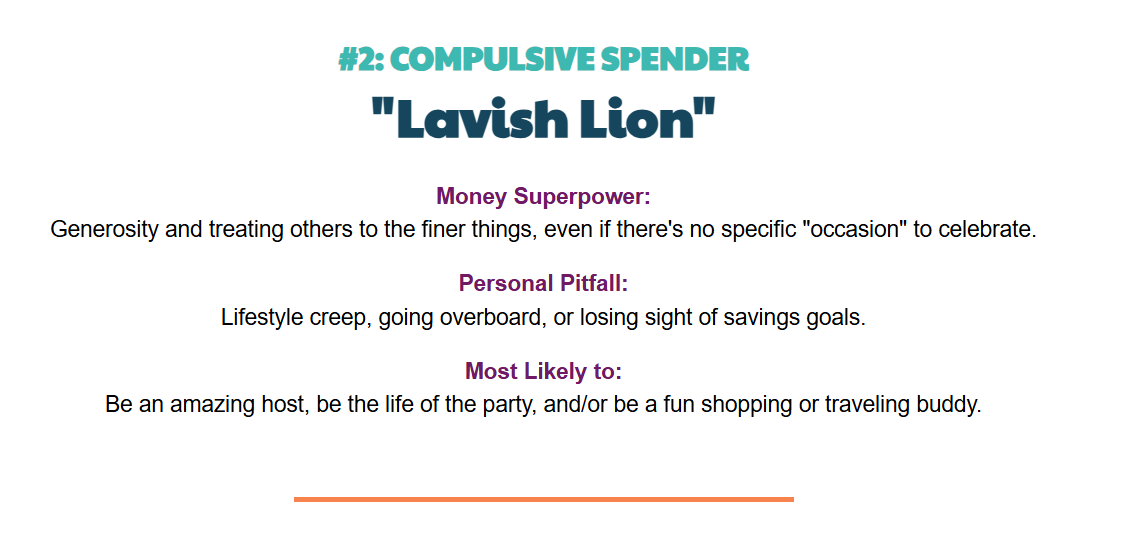

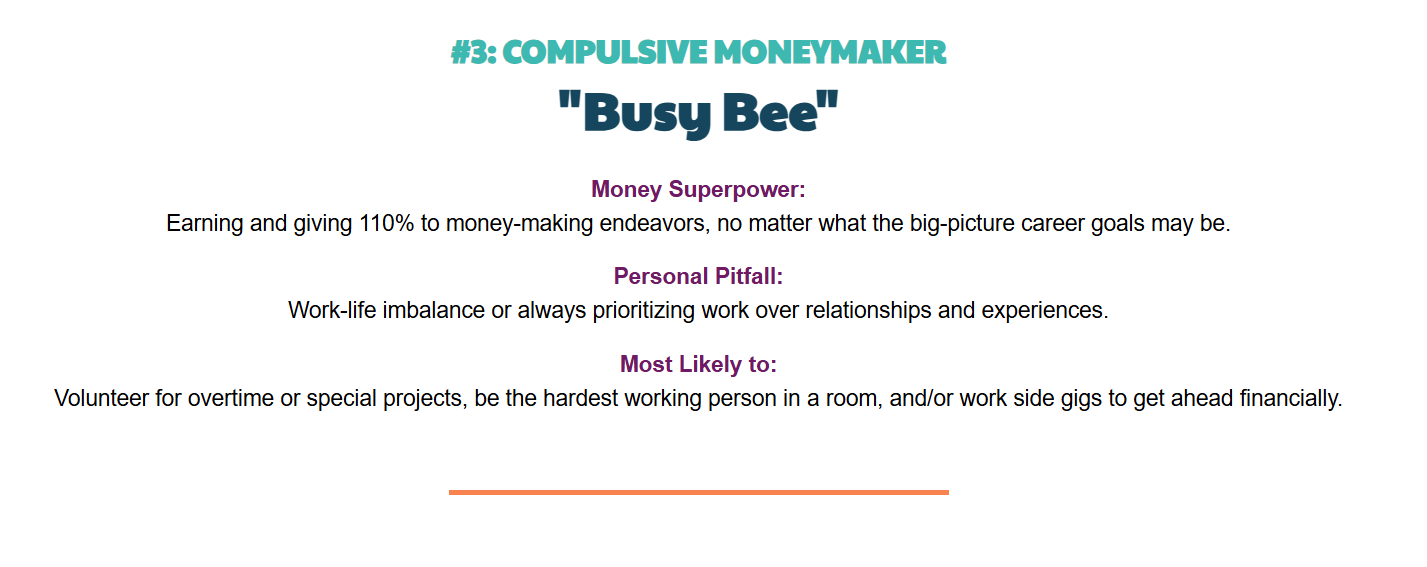

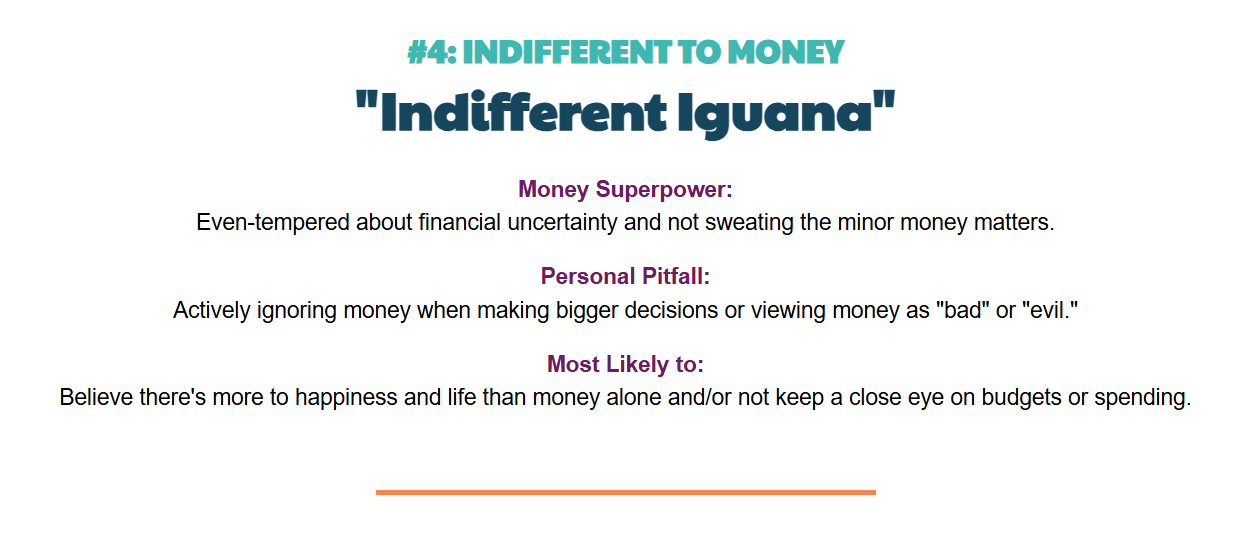

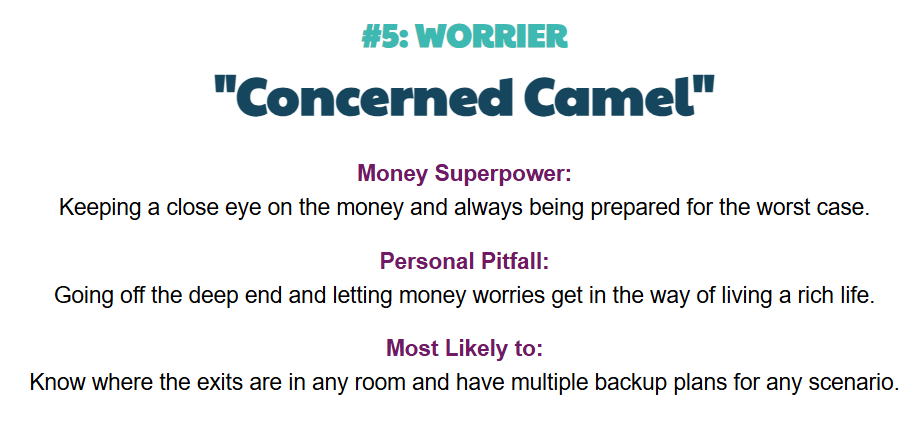

Let’s see by checking out some of the most common money personalities and the mindsets behind them.

What money mindset really hit home?

Did more than one feel like they were describing you?

If so, don’t be alarmed. Most of us don’t have just one money personality.2

We’re far more likely to have a “blended” money personality, combining a few different types.2

That can mean there’s a dominant type that overshadows the rest — and that we may have a few more superpowers in our back pocket and some more pitfalls to beware of.3

Blended or not, though, money personalities aren’t “good” or “bad” by nature.

They’re simply a way to understand our unconscious beliefs about money.2,3

Bringing those out into the light can make it easier to balance out the strengths and vulnerabilities in our money personalities.

And that can be key to building to a better relationship with money and making more sound financial choices.

So can a solid plan for the future and helpful advice from a professional you trust.

Not receiving our newsletter?

Get insightful info on finances and more in your inbox every month with the

VISUAL INSIGHTS NEWSLETTER

- https://www.verywellmind.com/are-people-with-high-iqs-more-successful-2795280

- https://www.cnbc.com/2021/04/28/7-money-personality-types-and-the-pitfalls-of-each.html#2022/10/07

- https://www.investopedia.com/articles/basics/07/money-personality.asp

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Advisory services offered through NewEdge Advisors, LLC, a registered investment advisor.

NOTICE: This email communication including all attachments transmitted with it may contain confidential information intended solely for the use of the addressee. If the reader or recipient of this communication is not the intended recipient, or you believe that you have received this communication in error, please notify the sender immediately by return email and PROMPTLY delete this email including all attachments without reading them or saving them in any manner. The unauthorized use, dissemination, distribution, or reproduction of this email, including attachments is strictly prohibited and may be unlawful.