I’m dropping you a quick note to talk about what’s going on with markets.

Well, it happened.

We knew that markets were going to continue their wild ride, and here we are.

Stocks slid into bear market territory after a bad May inflation report showed that prices rose at the fastest pace since 1981.¹

It’s clear that the Federal Reserve’s efforts to cool inflation haven’t borne fruit yet, and investors are nervous.

In response to these concerns about inflation, the Fed raised the benchmark interest rate by another 0.75 points, the most aggressive hike in nearly three decades.²

Their move will hopefully yield relief from rising prices but also means the cost of borrowing will go up, which could dent business and consumer spending.

Should I be worried about markets?

Cautious, yes. Wary, perhaps. Afraid or worried? No.

Here’s why:

Many of the stocks leading the fall were high flyers during the pandemic, so the pullback could be a healthy correction of overblown prices.³

Bear markets don’t last forever. On average, they tend to linger for roughly 15 months. However, the 2020 bear market only lasted 33 days.⁴

Half of the market’s best days have happened during a bear market, so I expect some good days ahead.⁵

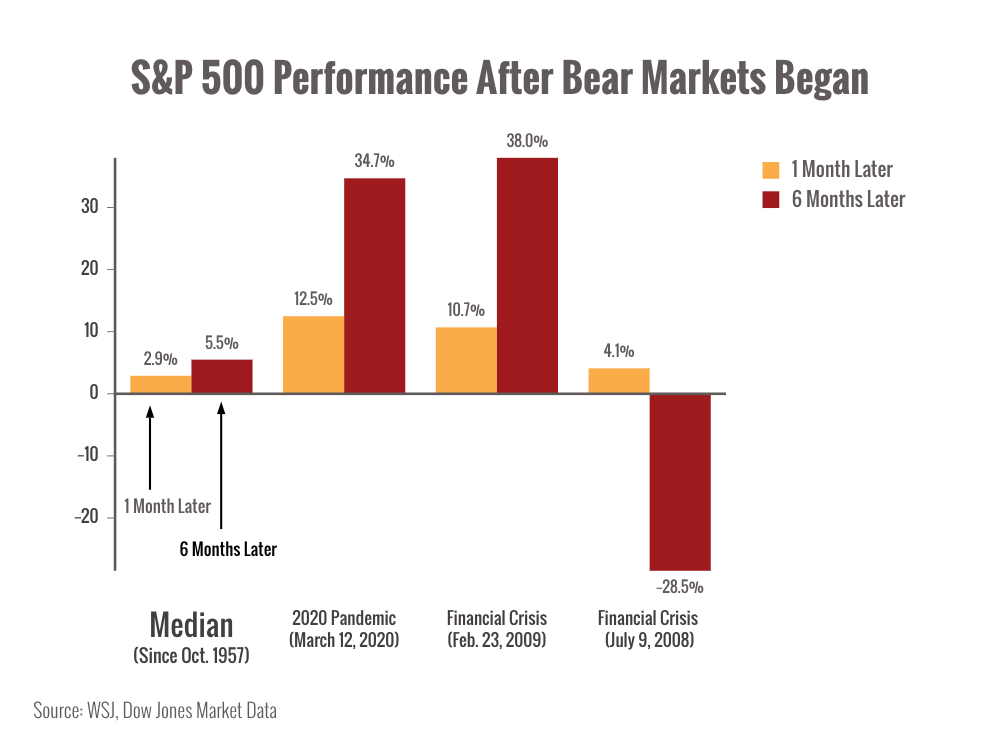

To give you some historical perspective here’s what happened during the last few bear markets:

You can see that in a couple of cases, markets bounced back within months. However, the 2008 bear market was a sustained pullback that lasted much longer.

Is history always an accurate predictor of the future? Definitely not. But we can look to it for hints about what may come.

What happens next?

Markets will likely continue to be extremely volatile over the next weeks and months as investors digest the Fed’s aggressive rate hikes as well as concerns about an economic slowdown.

The latest estimates still don’t point to a recession in 2022, but that could change.6

On the other hand, the next rounds of inflation data might show that prices are cooling off, which could give the Fed breathing room and avoid more aggressive hikes later.

We’ll have to wait and see.

What should I do now?

Great question, I’m so glad you asked. First of all, don’t panic.

We’ve been expecting wild market behavior and we’ve prepared for it.

The absolute worst thing you can do right now is to hit the eject button and bail on your investment strategy.

It’s impossible to perfectly time your reentry into markets and missing the ride back up could have a painful impact on your returns.

Market downturns can also create opportunities for selective bargain hunting if we stay flexible.

Bottom line: markets like these are natural and expected.

If you feel the need to sell or make drastic changes – please, please, please talk to me first.

I’m here, I’m watching markets, and I’ll reach out with specific recommendations as I have them.

Questions? Just hit “reply” to this email and let me know.

P.S. Need a break from the markets? Watch jellyfish float at the Monterey Bay Aquarium.

1 – https://www.cnbc.com/2022/06/10/consumer-price-index-may-2022.html

3 – https://www.wsj.com/articles/bull-markets-winners-dragged-the-s-p-500-into-a-bear-market-11655184522

4 – https://www.schwab.com/learn/story/market-volatility

5 – https://www.hartfordfunds.com/practice-management/client-conversations/bear-markets.html

The S&P 500 is an unmanaged composite index considered to be representative of the U.S. stock market in general. Returns based on closing price performance. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. For illustrative purposes only. Chart source: https://www.wsj.com/livecoverage/stock-market-today-dow-jones-bitcoin-fed-rates-06-14-2022/card/how-the-s-p-500-performs-after-closing-in-a-bear-market-yBwgfJwW8HGSNJaKg6LB

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Investment advisory services offered through NewEdge Advisors, LLC, a registered investment advisor. Advisory services are only offered to clients or prospective clients where NewEdge Advisors, LLC doing business as WealthWorth and its representatives are properly licensed or exempt from licensure. The information contained herein is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by NewEdge Advisors, LLC dba WealthWorth unless a client service agreement is in place.