Markets bucked and sold off again.¹ Should we be worried? Not necessarily. These things happen pretty regularly, especially when headlines are negative. In fact, you might recall that we kicked off 2022 with a big drop.² So, let’s talk about what’s behind the latest wild market ride. (Scroll to the end if you want to skip right to the reassurance.)

What led to the selloff? Primarily, economic worries.¹ Worries about new COVID-19 surges. Worries about Ukraine. Worries about the U.S. economy. A report just came out showing the economy shrank by 1.4% in the first three months of 2022, surprising analysts who expected positive growth of 1.0%.³ Though a single quarter of negative growth isn’t a recession, it’s a sign that inflation, the Ukraine conflict, and the pandemic hangover are weighing on the economy. Realistically, some form of a slowdown was probably inevitable, given the massive economic recovery of 2021. And, the news isn’t all gloom.

- This is a preliminary report, so we’ll see revisions later.

- Economists still believe the economy has plenty of room to grow, particularly given the strength of the job market, so the economy could rebound.

- Americans are continuing to spend.⁴

The economy is still strong, but it’s showing cracks. We’re watching closely.

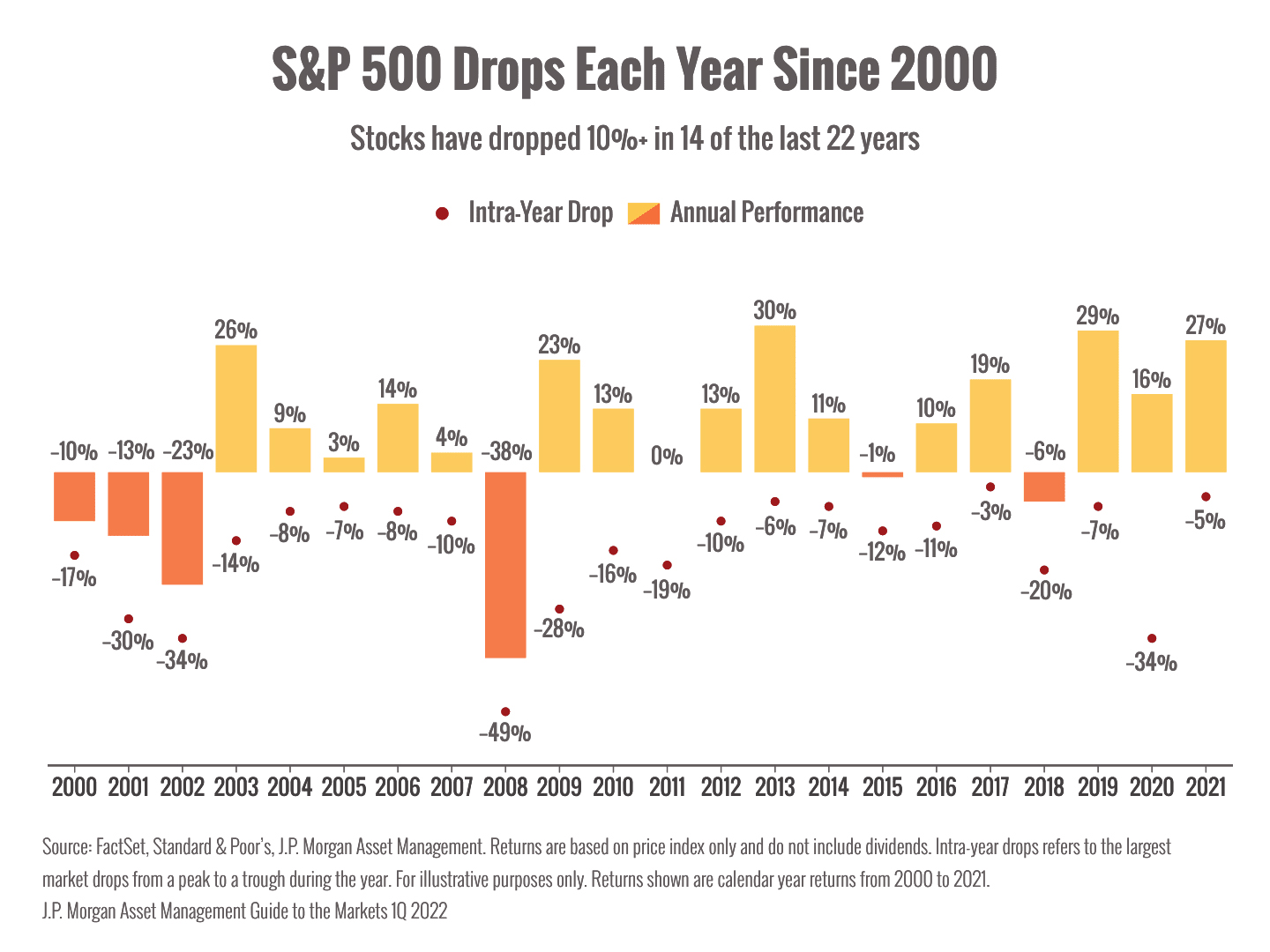

You can see a theme: markets are being driven by worry and fear. Is the selling done? That’s impossible to say. Could we see a bigger correction or bear market? Absolutely. That’s very possible. Corrections and pullbacks happen very frequently. Here’s a chart that shows intra-year dips in the S&P 500 alongside annual performance. (You’ve probably seen this chart before.) Take a look at the red circles to see the market drops each year.

The big takeaway? In 14 of the last 22 years, markets have dropped at least 10%.⁵ We’re dealing with a lot of uncertainty in 2022 and investors are feeling very cautious about the future. However, that doesn’t mean that we should hit the panic button and exit our strategies. Knee-jerk reactions to market turbulence can be VERY costly. I’m here. I’m watching the situation closely, and I’ll reach out directly if we need to make some changes. Questions? Concerns? Please hit “reply” and I’ll respond.

P.S. A mental snack: A TED talk by psycho-economist Sheena Iyengar on how we make choices

P.P.S. Want to feel more grateful for what you have? Here’s another great TED talk on the topic by Benedictine monk David Steindl-Rast. If you watch it, hit “reply” and let me know what you think!

Sources:

1 – https://www.cnbc.com/2022/

2 – https://www.cnbc.com/2022/01/

3 – https://www.cnbc.com/2022/04/

4 – https://www.washingtonpost.

Risk Disclosures:

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding the accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Investment advisory services offered through NewEdge Advisors, LLC, a registered investment advisor. Advisory services are only offered to clients or prospective clients where NewEdge Advisors, LLC doing business as WealthWorth and its representatives are properly licensed or exempt from licensure. The information contained herein is solely for informational purposes. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by NewEdge Advisors, LLC dba WealthWorth unless a client service agreement is in place.